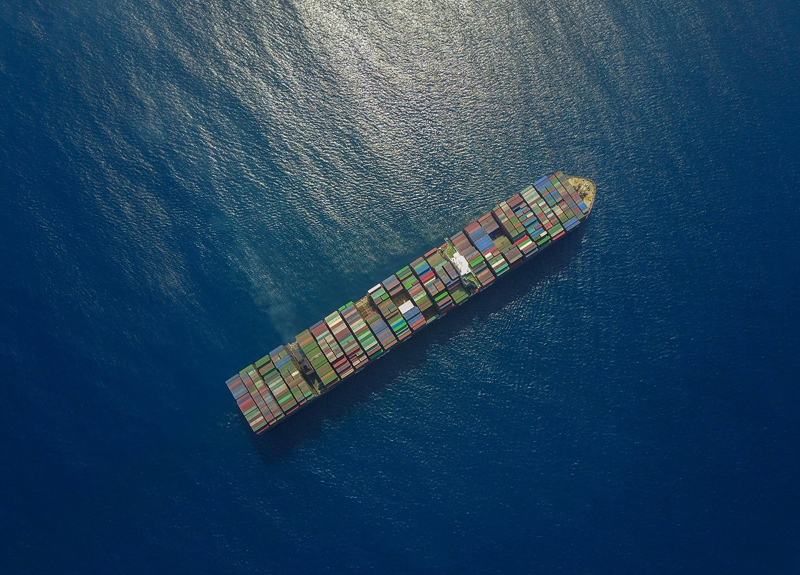

Logistics companies and importers are rushing to meet the new tariff deadline for the latest round of tariffs imposed by the US on China.

A 10% levy is to be applied to the declared value of any goods bought from Chinese suppliers, which will affect around $200 billion worth of goods. It’s set to be upped to 25% by the end of the year.

The difficulty for importers is a narrow window for implementation and uncertainty as to whether or not the systems in place can handle these changes quickly enough.

Shippers have been pushing their customs brokers to file the needed documentation, while customs brokers, who would ordinarily bill importers after the fact, have been encouraging their customers to set up their own transfer accounts with US Customs, so they don’t have to front so much of the cost.

Meanwhile, some importers are waiting for available slots on US ships as the biggest ocean carriers undergo rapid consolidation, contributing to further delays.

US Customs & Border Protection (CBP) is struggling to cope with the large volumes in particular thanks to the recent growth of e-commerce shipments and the raised de minimis threshold for duty-free imports, which increased from $200 to $800 in 2016.

The existing system does not support de minimis shipments, and traffic handled by forwarders and brokers is not automatically cleared when arriving as freight rather than mail or parcel shipments, requiring literal paperwork rather than electronic filings.

CBP have announced that an automated channel is on its way for de minimis shipments, as a top priority, but it’s not clear when this will be ready.

It’s also typhoon season across the Pacific.

Source: The Wall Street Journal, The Loadstar

On social media? Why not give us a follow...